Don't miss out on this exciting opportunity to diversify your retirement portfolio.

“Are you looking for a secure and innovative way to invest in the future of finance? Look no further than Bitcoin IRA! Our team of experts provides you with the best solutions to turn your traditional IRA into a Bitcoin IRA. With Bitcoin IRA, you can enjoy the benefits of investing in the world’s most popular cryptocurrency with the peace of mind that comes with a traditional retirement account.

What Is A Bitcoin IRA?

A Bitcoin IRA is a type of individual retirement account (IRA) that holds investments in bitcoin instead of traditional assets such as stocks, bonds, and mutual funds. A Bitcoin IRA operates similarly to a traditional IRA in terms of contributions, distributions, and tax treatment, but the underlying assets are different. By holding bitcoin in an IRA, investors are able to gain exposure to the cryptocurrency in a tax-advantaged manner, just as they would with traditional IRA investments.

Benefits Of A Bitcoin IRA

VS Traditional IRA

There are several potential benefits to investing in a Bitcoin IRA VS Traditional

- Potential for high returns: Bitcoin and other cryptocurrencies have seen significant price appreciation in recent years, and some investors believe that there is potential for further growth in the future. By investing in a Bitcoin IRA, investors have the opportunity to potentially earn higher returns compared to a traditional IRA that invests in stocks, bonds, or other traditional assets.

- Diversification: Adding bitcoin or other cryptocurrencies to your investment portfolio can help diversify your assets and reduce the overall risk of your portfolio.

- Decentralization: Unlike traditional IRAs, Bitcoin IRAs are based on a decentralized technology (blockchain) that allows for greater transparency and security in transactions.

- Protection from inflation: Bitcoin and other cryptocurrencies are not tied to a specific country or currency, which makes them less susceptible to inflation and other economic fluctuations that can negatively impact traditional investments.

How do you open up a Bitcoin IRA?

- Choose a custodian: The first step to opening a Bitcoin IRA is to choose a custodian that specializes in cryptocurrency IRAs. Make sure to research multiple options and choose a reputable custodian with a strong track record of security and customer service.

- Determine the type of IRA: Next, determine whether you want to open a traditional IRA or a Roth IRA. This will determine the tax treatment of your contributions and withdrawals.

- Complete the account application: After choosing a custodian, complete the account application, which will include personal information, investment goals, and funding information.

- Fund the account: Once the account has been established, you will need to fund it with either cash or a transfer from an existing IRA.

- Choose your investments: After funding the account, you can choose to invest in bitcoin or other cryptocurrencies offered by the custodian.

- Start investing: Once your investments are chosen, the custodian will handle the purchases and storage of the cryptocurrency on your behalf.

Why People Like You Chose Bitcoin IRAs

Diversification:

Bitcoin can provide diversification for a traditional investment portfolio, potentially reducing the overall risk of the portfolio.

Potential for growth:

Bitcoin has seen significant price appreciation since its inception, and some investors believe it has the potential for continued growth.

Tax benefits:

By holding bitcoin in an IRA, investors can take advantage of the tax benefits that come with traditional IRAs, including tax-deferred growth and tax-free withdrawals in retirement.

Control:

Bitcoin is a decentralized cryptocurrency. This can be appealing to investors who want to reduce their exposure to traditional financial systems and maintain more control over their investments.

What are the fees associated with opening a bitcoin IRA

vs Traditional?

The fees associated with opening a Bitcoin IRA can vary depending on the provider. However, here are some of the fees that are commonly associated with Bitcoin IRAs:

- Account setup fee: Some providers charge a one-time account setup fee to cover the cost of setting up the account and transferring the assets into the new account.

- Annual fee: Most providers charge an annual fee to cover the cost of maintaining the account and providing ongoing support and services.

- Transaction fee: Some providers charge a fee for each transaction made in the account, such as buying or selling cryptocurrencies.

- Management fee: Some providers charge a management fee to cover the cost of managing the portfolio and making investment decisions on behalf of the client.

- Custodian fee: Most providers use a third-party custodian to hold and manage the assets in the account. The custodian may charge a fee for their services.

- Cryptocurrency exchange fees: If investing in cryptocurrencies, there may be fees associated with buying, selling, or trading cryptocurrencies on a cryptocurrency exchange.

It’s important to carefully review the fees associated with each provider and factor in the cost when comparing providers and making a decision on which one to use. It’s also a good idea to consider the cost of any additional services that may be required, such as portfolio management or investment advice.

The fees associated with opening a traditional IRA can vary depending on the financial institution or brokerage firm you choose. Here are some of the common fees associated with traditional IRAs:

- Account setup fee: Some financial institutions charge a one-time fee to cover the cost of setting up the account.

- Annual fee: Some financial institutions charge an annual fee to cover the cost of maintaining the account and providing ongoing support and services.

- Maintenance fee: Some financial institutions charge a monthly or quarterly fee to cover the cost of maintaining the account and providing customer support.

- Transfer fee: Some financial institutions charge a fee if you want to transfer the assets in your IRA to another financial institution.

- Management fee: Some financial institutions offer managed investment options, such as mutual funds or exchange-traded funds (ETFs). These options may come with a management fee to cover the cost of professional investment management.

- Advisory fee: If you choose to work with a financial advisor, you may be charged an advisory fee for their services.

It’s important to carefully review the fees associated with each financial institution or brokerage firm and factor in the cost when comparing options and making a decision on which one to use. It’s also a good idea to consider the cost of any additional services that may be required, such as investment advice or portfolio management.

Why Choose Us

“Are you looking for a secure and innovative way to invest in the future of finance? Look no further than Bitcoin IRA! Our team of experts provides you with the best solutions to turn your traditional IRA into a Bitcoin IRA. You can enjoy the benefits of investing in the world’s most popular cryptocurrency with the peace of mind that comes with a traditional retirement account.

Our platform offers secure and insured storage solutions, giving you 24/7 access to your Bitcoin investments. Our team will guide you through the process, making it easy for you to invest in Bitcoin. Whether you’re a seasoned investor or just starting out, a Bitcoin IRA has you covered.

Start growing your retirement portfolio today with a Bitcoin IRA. Contact us to learn more!”

Bitcoin Sucess

Who were the early investors in bitcoin?

The early investors in bitcoin were a mix of individuals and organizations who saw potential in the technology and believed in its potential for disruption in the financial sector. Some of the early investors in bitcoin include:

Technology enthusiasts and libertarians: Many early bitcoin adopters were drawn to the technology for its potential to create a decentralized, peer-to-peer financial system that was not controlled by any government or financial institution.

Investors and speculators: Some early investors saw the potential for bitcoin to generate high returns, and bought the cryptocurrency as a speculative investment.

Miners: Bitcoin miners, who use their computer power to verify transactions and create new bitcoins, were also early adopters and investors in the technology.

Venture capitalists: Some venture capitalists saw the potential for bitcoin to disrupt the financial industry and invested in early stage startups working in the cryptocurrency space.

It is worth noting that the early days of bitcoin were characterized by a small, tight-knit community of investors, developers, and users. Over time, as the technology and its potential became more widely recognized, the number of people and organizations investing in bitcoin grew significantly.

Fun Fact:

Bitcoin was worth less than a dollar for most of its early existence. It wasn’t until February 9, 2011, that the price of one bitcoin rose above $1 for the first time. From that point on, the value of bitcoin began to fluctuate and rise, reaching new all-time highs in the following years. It is worth noting that the value of bitcoin can be highly volatile and subject to significant fluctuations, both up and down, in a short period of time.

IS A Bitcoin IRA, Right For You?

it’s important to consider your investment goals and risk tolerance before investing

Why does the price of bitcoin change So Often?

he price of bitcoin changes due to market demand. Bitcoin’s price is determined by how many people are willing to buy and sell it at a given time, and the price can be influenced by a number of factors, including:

News and events: Positive or negative news and events, such as government regulations or high-profile businesses accepting bitcoin, can affect its price.

Adoption rate: The more people adopt and use bitcoin, the higher its demand and, therefore, its price.

Supply and demand: Like any asset, bitcoin’s price is determined by supply and demand. If more people are demanding bitcoin than are selling it, the price will go up.

Market speculation: Speculation and market sentiment can also play a role in bitcoin’s price. If investors believe that the price of bitcoin will go up in the future, they may be more likely to buy it, driving up the price.

These are just some of the factors that can impact the price of bitcoin.

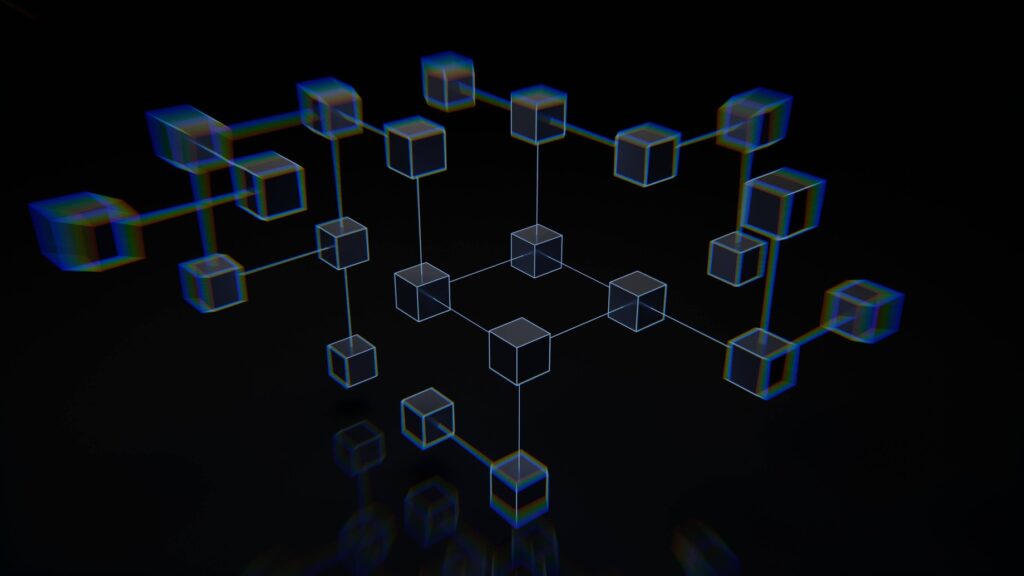

What is Blockchain in Crypto?

Blockchain is a digital ledger technology that allows for secure, transparent, and decentralized record-keeping of information or transactions. Think of it like a digital notebook where each page is a block that contains multiple transactions, and every page is connected to the previous one in a chain-like structure.

In a blockchain network, each block is verified by multiple nodes, rather than relying on a single central authority, making it secure and resistant to tampering or hacking. Once a block is added to the chain, it cannot be altered or deleted, creating an immutable record of all transactions.

The most well-known application of blockchain is Bitcoin, a decentralized digital currency that allows for peer-to-peer transactions without the need for intermediaries such as banks. However, blockchain can be used for a variety of other applications, such as supply chain management, digital identity verification, and voting systems.

In short, blockchain is a secure, transparent, and decentralized ledger technology that has the potential to revolutionize the way we store, share, and transfer information and assets.

© 2023 All Rights Reserved.

Have questions about starting a Bitcoin IRA or adding other cryptocurrencies to an IRA for us? We offer a wide range of products and services tailored to our client’s needs. Contact us today to discuss your specific needs or get a head start by ordering our free guide to starting a Bitcoin IRA.

Note that investing in a cryptocurrency comes with its own set of risks, such as high volatility, regulatory uncertainty. Additionally, the value of your investment may go down as well as up, so it’s important to consider your investment goals and risk tolerance before investing in a Bitcoin IRA.