Adding Bitcoin To Your 401K is easy.

Yes you can legally add Bitcoin to your 401(k) plan are long-term savings accounts that offer tax advantages if you comply with various Internal Revenue Service regulations. As Bitcoin and other cryptocurrencies gain credibility as legitimate investments, the investment world is working to make changes. One interesting change has been the acceptance of Bitcoin as a legitimate investment as part of an IRA account in the US

You can invest in Bitcoin with an IRA. You can roll over funds from an existing IRA, Roth IRA, or 401k into a self-directed Bitcoin 401k account or you can start a new Bitcoin IRA account with funds from your savings. At this time, you cannot roll your current Bitcoins into an IRA – the IRS requires that buying into a Bitcoin based IRA be done with US dollars. While you could only invest in bitcoin, you have options of investing in other cryptocurrencies as well..

One of things that makes Bitcoin such an interesting investment is the fact that Bitcoin’s price has grown from zero to above $10000 in a span of eight years. Someone who bought $400 worth of bitcoin in 2011 is worth over $2.5 million in 2017.

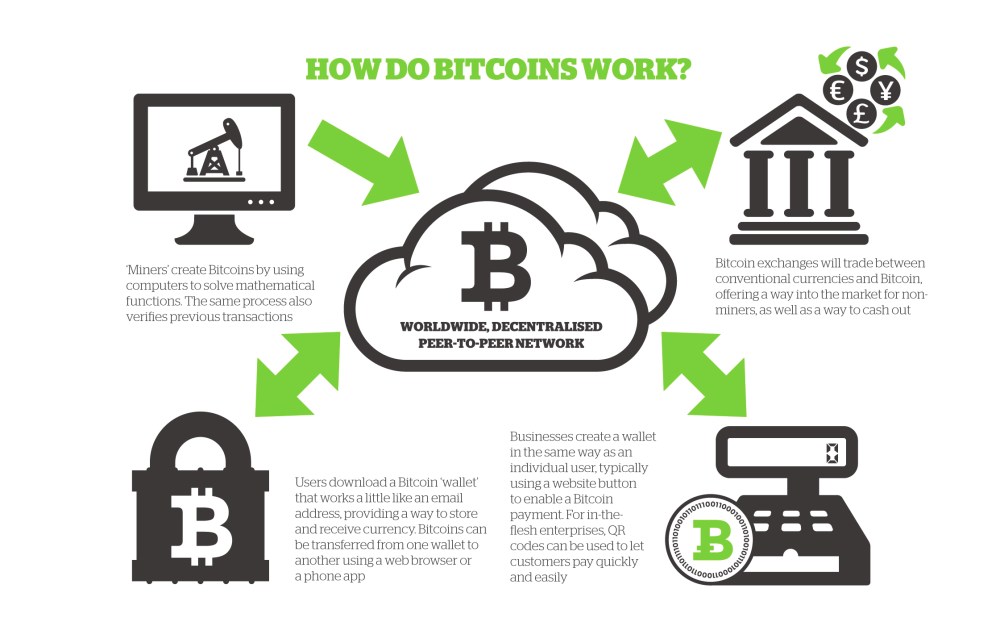

Does it have to be a Bitcoin 401k? You can use cryptocurrencies, such as Bitcoin, Ethereum and Litecoin, are designed to enable purchases, sales and other financial transactions, providing many of the same functions as long-established currencies such as the U.S. dollar, Peso or Euro

Does it have to be a Bitcoin 401k? You can use cryptocurrencies, such as Bitcoin, Ethereum and Litecoin, are designed to enable purchases, sales and other financial transactions, providing many of the same functions as long-established currencies such as the U.S. dollar, Peso or Euro

Why people use Bitcoin

- Cannot be debased. Limited to 21 million coins only.

- Unlike precious metals, No storage cost. Bitcoins take up no physical space, any amount can be stored.

- Easy to hide.

- Can be made anonymous, meaning nobody would even know you own bitcoins or how many.

- Easy to protect. Can be made impossible to steal or seize by any thief, government or bank.

- No counterparty risk. Coins are in your possession.